2025 Private SaaS Company Valuations

Valuing private SaaS companies can be a complex and often perplexing process. Two parties can analyze the same data and arrive at vastly different conclusions. For years, we’ve been committed to providing an objective, data-driven resource to help demystify the challenges of valuing private SaaS businesses.

Since 2007, SaaS Capital has been a trusted partner for private B2B SaaS companies, providing debt capital to over 130 firms. Our deep involvement in the SaaS market gives us unparalleled insight into equity raises and M&A transactions. Leveraging this knowledge, we introduced our first private SaaS valuation framework in 2016.

Over time, we’ve refined this valuation framework to ensure it remains a reliable tool for valuation. Built on more than a decade of statistical data, our methodology leverages real-time insights from the SaaS Capital Index™, which we update monthly. The result is a downloadable Excel model grounded in three key variables that drive private B2B SaaS valuations:

- Public market valuation multiples

- Annual Recurring Revenue (ARR) growth rate

- Net Revenue Retention (NRR)

Because these inputs can be updated with the latest data, the model is adaptable to any market condition, offering a dynamic foundation for determining a company’s valuation.

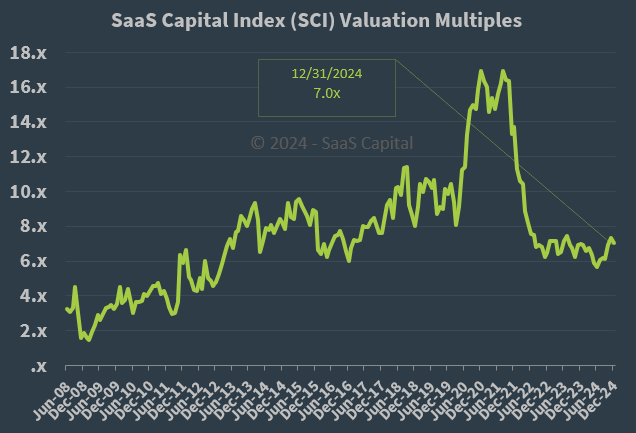

2025 Public SaaS Valuation Multiples

Public market valuations are an ideal starting point for crafting a private company valuation methodology. They represent the aggregated insights of countless market participants reacting to real-time data. With a broad sample of companies and reliance on audited financial results, public market valuations offer a high degree of data integrity.

To capture the most accurate representation of the public B2B SaaS landscape, we created the SaaS Capital Index. This index serves as a near real-time snapshot of the valuation multiples assigned to public SaaS companies. Unlike traditional businesses that use earnings multiples, SaaS companies are valued based on revenue multiples, reflecting the subscription-based nature of their business models. This is for two main reasons:

We begin 2025 with the SCI median valuation multiple standing at 7.0 times current run-rate annualized revenue (we believe run-rate revenue is the most accurate measure of the current scale of the business).

While the median multiple is down roughly 60% from its peak achieved in 2021, it has stabilized in the 6-7x range, which is where the SCI stood in the 2015-2016 period. However, there are key differences between today’s multiple and those from 8-9 years ago. Most notably, the current multiple reflects a very different balance between growth rates and profitability for the median company. [See our recent research: Why Long-Term SaaS Revenue Growth Rates are Slowing; and What it Means for Your Private B2B SaaS Company].

SaaS Capital Index Companies with the Highest Multiples

The table below lists companies from the SCI with the 10 highest ARR multiples.

Company

Current ARR Multiple

2023 ARR Multiple

YoY Change in Revenue

Profit Margin

Rule of 40

2024 Stock Performance

Crowdstrike

20.8x

18.7x

29%

-6%

23%

19%

ServiceNow

19.5x

15.3x

22%

15%

37%

34%

DataDog

17.5x

17.2x

26%

3%

29%

13%

Clearwater Analytics

14.6x

12.4x

22%

6%

29%

43%

Rubrik

14.5x

N/A

N/A

-61%

N/A

N/A

Palo Alto Networks

13.9x

12.1x

14%

13%

27%

2%

Snowflake

13.7x

21.1x

28%

-39%

-10%

-17%

HubSpot

13.4x

12.3x

20%

-1%

19%

15%

Guidewire Software

13.3x

N/A

27%

-2%

N/A

53%

Veeva Systems

12.2x

12.3x

13%

26%

39%

5%

SCI Universe Median Value

7.0x

7.0x

14%

-2%

13%

5%

The median multiple among the top 10 SCI constituents by ARR multiple is 14.2x as of year-end 2024. This compares to an average multiple of 7x for the broader SCI universe. There were two new entrants to the list of top 10 companies by ARR multiple in 2024: Rubrik and Guidewire Software. Rubrik went public in April 2024 and Guidewire Software was added to the SCI in July of 2024. Rubrik’s stock price appreciated 75% from its April IPO through year-end 2024 and Guidewire’s stock price outperformed the remainder of the top 10 companies by multiple, returning 53% in 2024.

SaaS Capital Index Companies with the Lowest Multiples

The table below lists companies from the SCI with the 10 lowest ARR multiples.

Company

Current ARR Multiple

2023 ARR Multiple

YoY Change in Revenue

Profit Margin

Rule of 40

2024 Stock Performance

Upland Software

.4x

.4x

-10%

-5%

-15%

2%

Domo

.9x

1.2x

0%

-21%

-21%

-37%

Bigcommerce Holdings

1.4x

2.2x

7%

-23%

-16%

-26%

Yext

1.8x

1.8x

13%

-9%

4%

11%

Kaltura

1.9x

1.5x

2%

-10%

-8%

21%

CS Disco

2.0x

3.2x

4%

-30%

-26%

-40%

Expensify

2.1x

1.4x

-3%

1%

-2%

101%

Fastly

2.4x

4.5x

7%

-30%

-22%

-55%

Definitive Healthcare

2.6x

6.1x

-4%

-359%

-363%

-50%

Sprinklr

2.7x

4.3x

8%

4%

12%

-34%

SCI Universe Median Value

7.0x

7.0x

14%

-2%

13%

5%

The bottom 10 companies by ARR multiple in the SCI have a median multiple of 1.9x. For the second year Upland Software had the lowest multiple in the SCI universe at 0.4x. Unsurprisingly, fundamentals for the bottom 10 companies were significantly worse than those of the top 10 companies by ARR multiple. Weak to negative revenue growth and negative profit margins explain the low multiples among this group. It is noteworthy, however, that the best stock performance among the top 10 and bottom 10 companies by multiple came from a company in the bottom 10: Expensify returned 101% in 2024.

What is the Current Private SaaS Company Valuation Multiple?

Using the most recent growth and retention data for private B2B SaaS companies1, along with the current SCI of 7.0, we can calculate a predicted valuation multiple for both bootstrapped and equity-backed companies.

Data for bootstrapped companies yields a predicted private SaaS company valuation multiple of 4.8x while data for equity-backed companies yields a predicted valuation multiple of 5.3x.

Observations and Predictions

Rob Belcher, Managing Director, recently sent some thoughts to the SaaS Capital community on the current market:

- Economic uncertainty: Going into 2025, economic uncertainty is the watch phrase. The direction and magnitude of economic impacts from inflation, interest rates, proposed US tax and policy changes, among other drivers, are highly uncertain at the moment.

- Accelerating SaaS M&A and IPOs: The Fed has indicated it is in a rate-cutting cycle and, traditionally, lower interest rates spur growth and economic activity. We estimate that SaaS M&A and IPO activity will gradually accelerate in 2025 – yesterday’s very successful ServiceTitan IPO shows potential green shoots here.

- But Series A venture deals are still a ways off: In 2024 we saw VCs prioritize later-stage, larger dollar rounds, in a move toward less risky deals. Bona fide Series A deals are scarce at the moment, and likely not returning until the aforementioned upstream capital markets components move to “risk on” mode: lower rates drive more M&A and IPOs, which leads to Limited Partner liquidity, which will flow back into new VC and PE funds, who then invest those funds in Seed and Series A investments. This process will take time; early-stage venture may not thaw until 2026 at the earliest.

- Valuations between 5.5x and 8.0x ARR: That all said, we expect public SaaS valuations to remain in their current band of 5.5x to 8x current run-rate ARR, with possible upside potential later in the year.

- A shift towards growth vs. profitability: As we’ve shown in our research, SaaS companies’ decisions to emphasize growth vs. profitability are well correlated with changes in interest rates. If rates drift downward, expect companies to begin to re-emphasize growth. Should rates remain elevated or rise further, expect profitability to remain a priority.

- Artificial Intelligence is most impactful in content generation: AI in 2025 will be most seen in text, image, and video creation: “Generative AI.” Companies reliant on content marketing and SEO will run into mass-produced AI “slop” issues increasingly in 2025. AI could threaten a SaaS business if it produces content, sells to content creators, or provides a customer support product (e.g. chatbots). But we generally think B2B systems of record SaaS platforms are immune from the current version of AI. You can read more on our thoughts on AI + SaaS here.

- 2025 will be another good year to run a SaaS business! Despite generationally high interest rates, the prior two years were excellent periods to use debt for SaaS growth. We think this will continue in 2025 as equity remains expensive and/or limited.

1 In Q1 of each year, SaaS Capital conducts a survey of B2B SaaS company metrics. The current survey marks our 13th annual survey, and it continues to grow with more than 1,500 private B2B SaaS companies responding, making it the largest survey of its kind.

![]()